palm beach county business tax receipt phone number

I hereby apply for a Home Based Business Tax Receipt to use a business telephone listing business stationery and conduct minor business activity of a business office at my residence. Please submit your business tax application or rental license application via email to.

Tax Planner Services Guide Annual Report to Our.

. 301 North Olive Avenue 3rd Floor West Palm Beach FL 33401 561 355-2264 Contact Us. How to obtain a business tax receipt Follow these steps to get a business tax receipt for your company. 200 Civic Center Way Royal Palm Beach FL 33411 Map If you are looking for additional information about Drivers License Renewals Auto Tag Renewals andor Registrations Handicap Permits HuntingFishing Licenses or any other County Tax related business OTHER THAN registering for a Business Tax Receipt please call 561 355-2264.

Any person selling merchandise or services in Palm Beach County must have a local business tax receipt. Businesses operating from newly constructed commercial locations in the City of Palm Coast please attach your Certificate of Occupancy obtained from the Building Department 386986-3780 with your Business Tax Receipt application. Hours Monday - Friday 800 am - 400 pm.

What the Tax Receipt Is. IRSC Small Business Development Center Phone. Monday - Friday 800 am.

Royal Palm Beach FL 33411. Locations Outside of the City. Service Core of Retired Executives SCORE Phone.

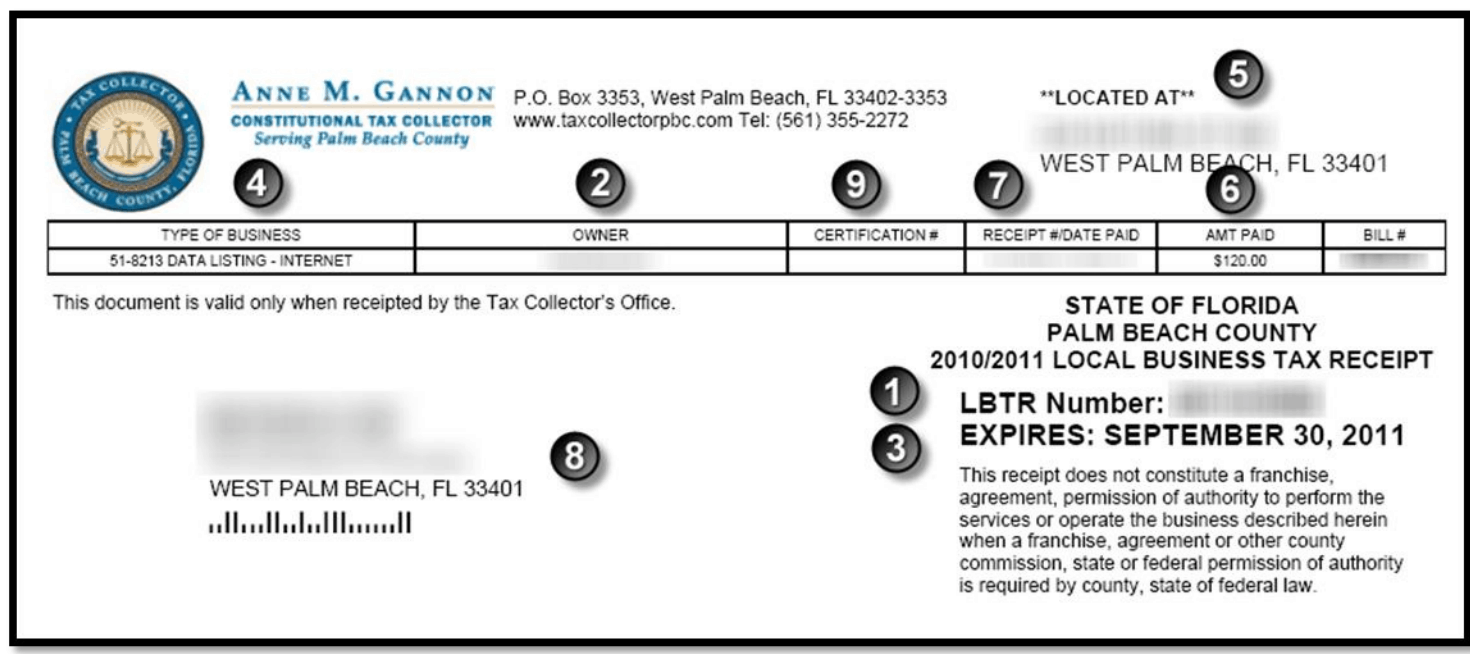

When results are returned click the LBTR Number to view andor pay. Important Information Local Business Tax Receipt Information. The maximum fee is 23625 for a company or business with 51 or more employees.

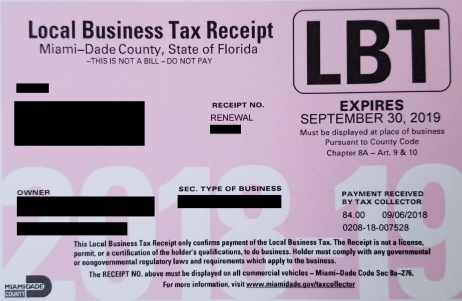

Palm Beach FL 33480. Local Business Tax Constitutional Tax Collector 2 2 City Of West Palm Beach Business Tax Fill Out And Sign Printable Pdf Template Signnow 2 2 2 2017 2022 Form Fl Fn Ad 003 Miami Fill Online Printable Fillable Blank Pdffiller. Find Forms Here What is business tax.

Economic Council of PBC. Lucie City Hall Phone. Subject to regulations of zoning health and any other lawful authority Section 17-17 of Palm Beach County Ordinance No.

Unincorporated - Palm Beach County Zoning Approval If business is located in unincorporated Palm Beach County submit this application to Palm Beach County Planning Zoning Building for approval 2300 N. 360 South County Road. Business Owner Enter by Last Name First Name LBTR Number Local Business Tax Receipt Mailing Address Business Address location Business NameTrade Name doing business as -- dba name Click Search.

Home business county number phone. Burkhart Today To Assist With All OF Your Local And County Tax Receipt Questions And Needs At 561 880-0155. Office of the Monroe County Tax Collector 1200 Truman Ave Ste 101 Key West FL 33040 305 295-5000.

Search only database of 11 mil and more summaries. Local And County Tax Receipt Laws. I certify that I am.

County Line Ad Contract and Deadlines. Find Palm Beach County Tax Records. Location Ownership Legal Business Name Dba Name Applicant.

Palm Beach County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Palm Beach County Florida. Application For a Palm Beach County Local Business Tax Receipt. 561-355-2264 9 hours ago Constitutional Tax Collector.

The fees increase proportionately to the number of employees a business has. Town of Palm Beach. Administrative Office Governmental Center 301 North Olive Avenue 3rd Floor West Palm Beach FL 33401 561 355-2264 Contact Us.

These records can include Palm Beach County property tax assessments and assessment challenges appraisals and income taxes. Application for Home Based Business Tax Receipt Your Business Tax Receipt is issued subject to Palm Beach Gardens Code Section 78-159 1. Palm beach county business tax receipt phone number Wednesday June 15 2022 Edit.

Palm Beach Gardens FL 33410. Allow 7 to 10 business days to process. 120 Malabar Road Palm Bay FL 32907.

Palm beach county business tax receipt phone number Saturday February 26 2022 Edit. Royal Palm Beach Application. Business Tax Receipt Exemption Form PDF Cancel Business Tax Receipt PDF Applying For Local Business Tax Receipt.

Village Hall 1050 Royal Palm Beach Blvd. APPLICATION FOR PALM BEACH LOCAL BUSINESS TAX RECEIPT __ NEW Business Tax Receipt __ CHANGETRANSFER Circle. A team member will respond and provide you an account number how to pay online and next steps plus answer any questions you may have.

West Palm Beach-Vista Center 561-233-5200. CED Department is responsible for the issuance and collection of all Business Tax Receipts under the authority of Chapter 110 of the City of Palm Bay Code of Ordinance. Register your business You need a business before you can ask the local government to let.

Development Services Department 401 Clematis Street West Palm Beach Florida 33401 Phone. PO Box 2029. This requirement includes one-person and home-based businesses.

FOR OFFICE USE ONLY.

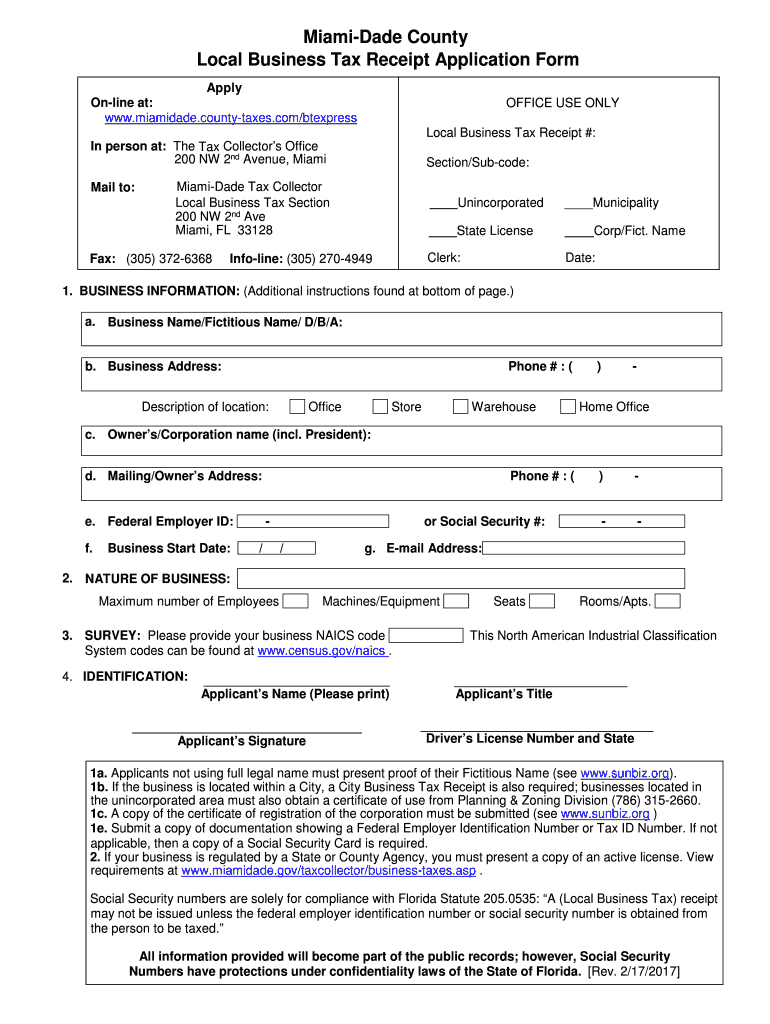

Fl Local Business Tax Receipt Application Form Miami Dade County 2017 2022 Fill Out Tax Template Online Us Legal Forms

Palm Beach County Local Business Tax Receipt 305 300 0364

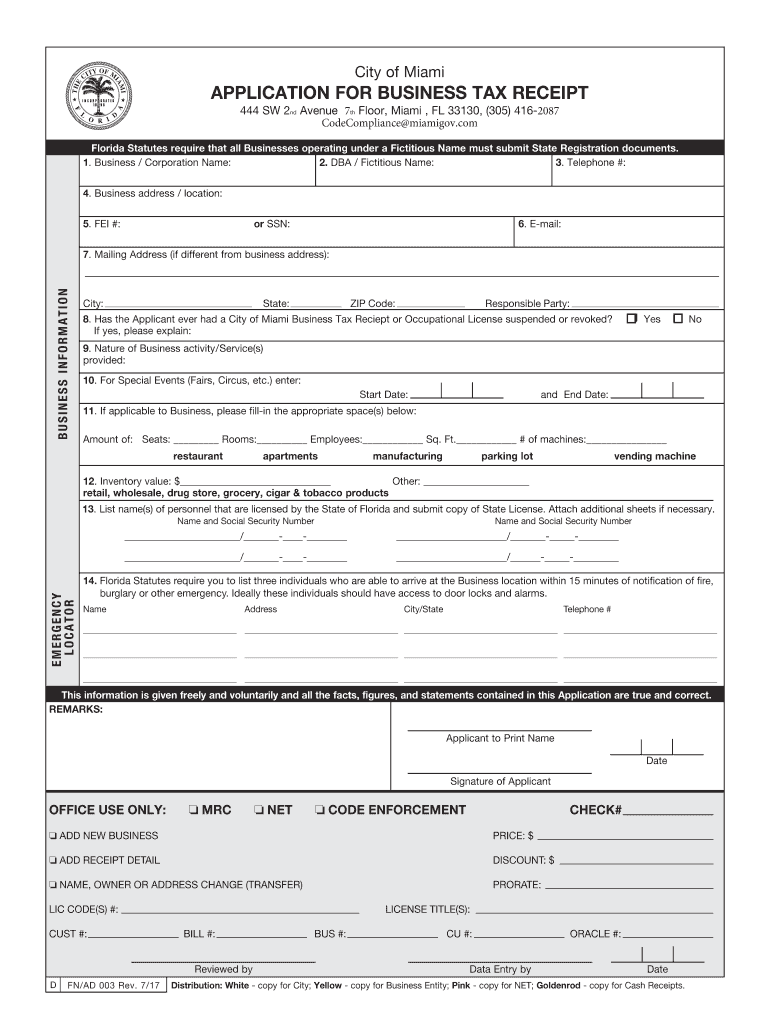

2017 2022 Form Fl Fn Ad 003 Miami Fill Online Printable Fillable Blank Pdffiller

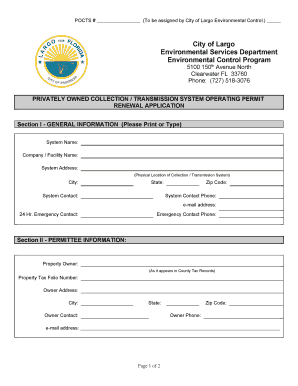

Fill Free Fillable Constitutional Tax Collector Pdf Forms

Fort Lauderdale Area Broward County Local Business Tax Receipt 305 300 0364

2017 2022 Form Fl Fn Ad 003 Miami Fill Online Printable Fillable Blank Pdffiller

Local And County Tax Receipt Laws In Palm Beach County

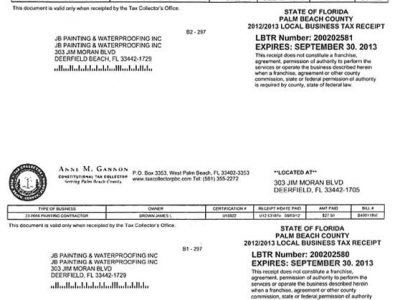

Licences Certificate Of Competency Registration Jb Painting Waterproofing Inc

Permit Source Information Blog

Local Business Tax Constitutional Tax Collector